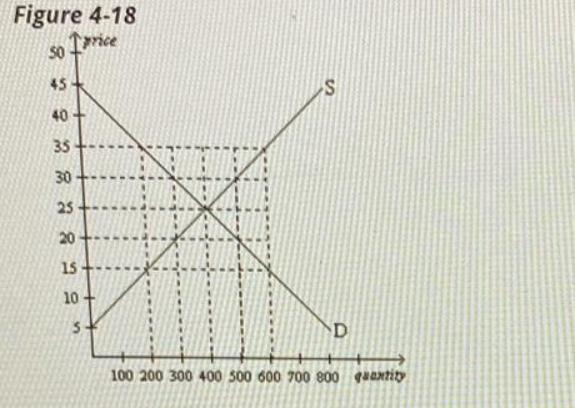

At a price of $35, there would be Select one: a. excess demand, and the price would tend to fall from $35 to a lower price. b. a shortage, and the price would tend to rise from $35 to a higher price. c. excess supply, and the price would tend to fall from $35 to a lower price. d. a surplus, and the price would tend to rise from $35 to a higher price.

Answers

Answer: c. excess supply, and the price would tend to fall from $35 to a lower price.

Explanation:

At $35 there is excess supply because this is a price that most consumers are not willing to pay but most suppliers are willing to sell.

Supply at $35 = 600

Quantity demanded at $35 = 200

This would lead to prices falling as suppliers try to sell the excess supply. The prices would ideally keep falling till the equilibrium price is reached which is $25. At this point, the quantity demanded and supplied will be equal to each other.

Related Questions

In 2018, the CEO of General Dynamics (an aerospace and defense company), Phebe Novakovic, received a total compensation of about $20.7 million. This was estimated to be approximately 240 times the median General Dynamics employee's compensation. In 2018, General Dynamic's market value was approximately $47 billion. Which of the following explains why companies are willing to pay so much money for good managers?

a. A good manager can increase the value of a company. Even a small change in the value of a large company can mean a significant return to individual shareholders.

b. Top-level management requires extensive training and education so potential executives require a high salary to make up for lost earnings gaining that training.

c. CEOs are always paid significantly more because there are so few people willing to work as a chief executive.

Answers

Answer:

a. A good manager can increase the value of a company. Even a small change in the value of a large company can mean a significant return to individual shareholders.

Explanation:

The managers are those person who need to manage the business operations by following things

a. planning

b. coordination

c. efficiently work

d. Accomplishing objectives of the company

e, Optimal resource utilization

So from the above manager functions we can say that the good manager could rise the firm value via accomplishing the company objectives that would develop the goodwill also at the same time it would rise the market capitalization via attracting customers

Lease or Sell Casper Company owns a equipment with a cost of $366,000 and accumulated depreciation of $53,200 that can be sold for $273,400, less a 3% sales commission. Alternatively, Casper Company can lease the equipment to another company for three years for a total of $285,200, at the end of which there is no residual value. In addition, the repair, insurance, and property tax expense that would be incurred by Casper Company on the equipment would total $15,100 over the three years.

Prepare a differential analysis on March 23 as to whether Casper Company should lease (Alternative 1) or sell (Alternative 2) the equipment. For those boxes in which you must enter subtracted or negative numbers use a minus sign.

Answers

Answer:

The Company should sell the equipment (Alternative 2)

Explanation:

Preparation of a differential analysis on March 23 as to whether Casper Company should lease (Alternative 1) or sell (Alternative 2) the equipment.

DIFFERENTIAL ANALYSIS

Lease Equipment (Alt. 1) or Sell Equipment (Alt. 2) March 23, 2014

Lease Equipment (Alternative 1); Sell Equipment (Alternative 2) Differential Effect on Income (Alternative 2)

Revenues $285,200 $273,400 –$11,800

Costs –$15,100 –$8,202 $6,898

($273,400*3%=$8,202)

Income (Loss) $270,100 $265,198 $4,902

Based on the above Differential Analysis the Company should sell the equipment (Alternative 2) reason been that the company income will increase by $4,902 If the Equipment is sold out.

present value of bonds payable; premium moss co. issued $740,000 of four-year, 12% bonds, with interest payable semiannually, at a market (effective) interest rate of 11%. determine the present value of the bonds payable, using the present value tables in exhibit 5 and exhibit 7. round to the nearest dollar. $fill in the blank 1

Answers

Answer:

ijiji

Explanation:

hug

Accents Associates sells only one product, with a current selling price of $130 per unit. Variable costs are 60% of this selling price, and fixed costs are $40,000 per month. Management has decided to reduce the selling price to $125 per unit in an effort to increase sales. Assume that the cost of the product and fixed operating expenses are not changed by this reduction in selling price. At the current selling price of $130 per unit, what dollar volume of sales per month is required for Accents to earn a monthly operating income of $20,000

Answers

Answer:

Break-even point (dollars)= $150,000

Explanation:

Giving the following information:

Selling price= $130

Unitary variable cost= 130*0.6= $78

Fixed costs= $40,000

Desired profit= $20,000

To calculate the sales in dollars to reach the desired profit, we need to use the following formula:

Break-even point (dollars)= (fixed costs + desired profit) / contribution margin ratio

Break-even point (dollars)= (20,000 + 40,000) / [(130 - 78) / 130]

Break-even point (dollars)= 60,000 / 0.4

Break-even point (dollars)= $150,000

For the year ended December 31, 2021, Norstar Industries reported net income of $960,000. At January 1, 2021, the company had 1,050,000 common shares outstanding. The following changes in the number of shares occurred during 2021:

Apr. 30 Sold 80,000 shares in a public offering.

May 24 Declared and distributed a 5% stock dividend.

June 1 Issued 90,000 shares as part of the consideration for the purchase of assets from a subsidiary.

Required:

Compute Norstar's earnings per share for the year ended December 31, 2021. (Enter your answers in thousands. Round "EPS" answer to 2 decimal places. Do not round intermediate calculations.)

Answers

Answer:

Earning per share for the year ended December 31, 2021 on Norstar's earnings = $0.79 per share

Explanation:

Earning per share is calculated as

Net income reported / Weighted number of outstanding shares

where,

Net income reported is $960,000

And, the weighted number of outstanding share is

For Jan.1

Jan 1 2021 shares × stock dividend

Dividend = 100 + rate = 100 + 0.05 = 1.05

1,050,000 x 1.05=$1, 102,500

For April

April 30 shares × stock dividend× number of months / total number of months in a year

80,000 x 1.0 5 x 8/12(April 30 to December 31 = 8 months)=56,000

For June

June 1 shares × number of months/ total number of months in a year

90,000 x 7/12=56,000

Total weighted number of outstanding shares =$1,102,500+56,000+52,500= $1,211,000

So, the earning per share is

= 960,000 / $1,211,000 shares

= $0.79 per share

Project Droid has a net present value of $45,000 and has an initial investment of $180,000. Project Clone has a net present value of $8,000 and has an initial investment of $30,000. The projects are proposals for increasing revenue and are mutually exclusive. The firm should accept... Only Project Clone should be accepted Only Project Droid should be accepted Neither Project should be accepted Both Project Clone and Project Droid should be accepted

Answers

Answer:

Neither Project should be accepted

Explanation:

Given that

The net present value and the initial investment of the project droid is $45,000 and $180,000 respectively

And, the net present value and the initial investment of the project clone is $8,000 and $30,000 respectively

Since the net present value of both the projects are less than their initial investment so both the projects should not be accepted as the net present value is in negative

The unadjusted trial balance at year-end for a company that uses the percent of receivables method to determine its bad debts expense, reports the following selected amounts: Accounts receivable $ 431,000 Debit Allowance for Doubtful Accounts 1,390 Debit Net Sales 2,240,000 Credit All sales are made on credit. Based on past experience, the company estimates 2.5% of ending account receivable to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense

Answers

Answer:

Bad Debts Expense $9,385 & Allowance for Doubtful Accounts $9,385

Explanation:

Bad debt expense = ($431,000 *2.5%) - $1,390

Bad debt expense = $10,775 - $1,390

Bad debt expense = $9,385

Adjusted Entry

Debit - Bad Debts Expense $9,385

Credit - Allowance for Doubtful Accounts $9,385

Jones Company developed the following static budget at the beginning of the company's accounting period: Revenue (8,000 units) $ 16,000 Variable costs 4,000 Contribution margin $ 12,000 Fixed costs 4,000 Net income $ 8,000 If actual production totals 8,200 units, the flexible budget would show total costs of:

Answers

Answer:

the total cost in the flexible budget is $8,100

Explanation:

The computation of the total cost in the flexible budget is shown below;

Variable cost per unit is

= $4000 ÷ 8,000 units

= 0.50 per unit

The total cost for the flexible budget is

= Variable costs+ fixed costs

= 0.5 × 8,200 units + $4,000

= $4,100 + $4,000

= $8,100

Hence, the total cost in the flexible budget is $8,100

What is the purpose of a W-2 form and how is it used to file taxes?

Answers

The following T-account is a summary of the cash account of Alixon Company.

Cash (Summary Form)

Balance, Jan. 1 8,000

Receipts from customers 364,000 Payments for goods 200,000

Dividends on stock investments 6,000 Payments for operating expenses 140,000

Proceeds from sale of equipment 36,000 Interest paid 10,000

Proceeds from issuance of bonds payable 8,000 Taxes paid 300,000

Dividends paid 40,000 Balance, Dec. 31 316,000

Required:

What amount of net cash provided (used) by financing activities should be reported in the statement of cash flows?

Answers

Answer and Explanation:

The computation of the amount of net cash provided (used) by financing activities is shown below

Cash flows from financing activities

Proceeds from issuance of bonds payable $300,000

Less: dividend paid -$40,000

Net cash flow provided by financing activities $260,000

The positive amount represent the cash inflow while on the other hand the negative amount represent the cash outflow

The Clean Water Act (CWA) of 1972 did all of the following except _____.

take over the EPA's authority to impose pollution control programs

not permit pollutants to be discharged from pipes or man-made ditches into navigable waters

regulate pollutants discharged into US waters

set water-quality standards

Answers

Answer: The Clean Water Act (CWA) of 1972 did all of the following except

take over the EPA's authority to impose pollution control programs.

Answer:

The Clean Water Act (CWA) of 1972 did all of the following except _take over the EPA's authority to impose pollution control programs[held on 1990]____.

Signet Automobiles Inc. has launched a new sport utility vehicle (SUV). Its advertising firm develops a marketing message and places advertisements in leading newspapers and on social media sites to inform consumers about the new SUV and its various features. In the context of the communication process, Signet Automobiles is the _______.

Answers

Answer:

sender

Explanation:

In the communication process, Signet Automobiles is the sender of the message, that is, the element that transmits the message to the receiver.

The communication process is formed by the following elements: sender, channel, message, code and receiver. The main objective of the process is to transmit a message using a code and a communication channel to a receiver. In this case, the receiver is the target audience of the company Signet Automobiles, which will receive the advertising message through the communication channel, which is newspapers and social media sites.

The communication process is essential for every company, the transmission of messages effectively is that it will assist the company in its correct operation in the internal and external environment, and it is an essential tool for the positioning of a company in the market.

How do worker organizations influence wages?

A. They require workers to have more education.

B. They fight for higher pay for workers.

C. They enforce regulations raising the minimum wage.

O

D. They lower the market value of workers.

SUBMIT

Answers

What is a sole proprietor?

O A. A person who starts any new business

B. A person who runs a business in which he or she is the only

employee

C. A business structure that protects the owner from lawsuits

O D. Two people who start up a business together

Answers

Answer:

B. A person who runs a business in which he or she is the only

employee

A person who runs a business in which he or she is the only employee is a sole proprietor. The correct option is (B).

What do you understand by the sole proprietorship?A sole proprietorship is a type of company or group that is owned, controlled, and run by a single person who also bears all the risks and is the only one to benefit from any gains or losses.

Typically, these companies offer specialty services like hair salons, spas, or tiny retail stores.

A single proprietor is allowed to choose whatever they want. They wouldn't need to ask others for approval, so the choice would be quick.

Being the sole proprietor of the company enables him or her to maintain the privacy and confidentiality of all business information

Therefore, a person who runs a business in which he or she is the only employee is a sole proprietor.

To know more about the sole proprietorship, visit:

https://brainly.com/question/1428023

#SPJ2

State whether true or false and briefly explain why:

If a business owner is delighted to accept additional orders at the current price, he or she cannot have been a profit-maximizing, perfectly competitive producer. A profit-maximizing, perfectly competitive firm would have been producing such that the multiple choice P > MC, so producing more would mean that the marginal cost increases to match the market price; so this is false. P = AC, so producing more would mean that the average cost would exceed the price reducing profits; so this is true. P = MC, so producing more would mean that the marginal cost would exceed the price reducing profits; so this is true. MR < MC, so producing more would mean that the marginal cost increases to match the market price; so this is false.

Answers

Answer:

Stating True or False

P > MC, so producing more would mean that the marginal cost increases to match the market price. FALSE

P = AC, so producing more would mean that the average cost would exceed the price reducing profits. FALSE

P = MC, so producing more would mean that the marginal cost would exceed the price reducing profits. TRUE

MR < MC, so producing more would mean that the marginal cost increases to match the market price. FALSE

Explanation:

All profit-maximizing producers accept a market price (P) that is equal to the marginal cost (MC), i.e. (P = MC). At this point, the market price does not exceed the marginal costs (costs of factors of production). When = P > MC, it shows that the benefits of producing more goods exceed the production costs, to the benefit of the society. However, if P < MC, then the social costs of producing the goods exceed the social benefits, signalling that the economy should produce less.

QUESTION 1 Pure Comfort manufactures and sells mattresses with adjustable air chambers. Pure Comfort has been producing and selling approximately 500,000 units per year. Each units sells for $630, and there are no variable selling, general, or administrative costs. The company has been approached by a foreign supplier who wishes to provide the air compressor component for $95 per unit. Total annual manufacturing costs, including air compressors, is as follows: Direct materials $54,000,000 Direct labor 83,000,000 Variable factory overhead 17,000,000 Fixed factory overhead 36,000,000 If Pure Comfort outsources the air compressor, it is expected that direct materials will be reduced by 25%, direct labor by 35%, and variable factory overhead by 30%. There will be no reduction in fixed factory overhead. (a) Calculate the total cost of each option (internal and outsource). Should Pure Comfort outsource the air compressor

Answers

Crane Company incurred the following costs for 50000 units: Variable costs $300000 Fixed costs 392000 Crane has received a special order from a foreign company for 2000 units. There is sufficient capacity to fill the order without jeopardizing regular sales. Filling the order will require spending an additional $4000 for shipping. If Crane wants to break even on the order, what should the unit sales price be?

Answers

Answer:

see explanation

Explanation:

Use the Fixed Costs, Variable costs and Sales arising from the special order only and follow the steps below :

Step 1 : Determine the Break even level in sales revenue

Break even (sales revenue) = Fixed Costs ÷ Contribution margin ratio

Step 2 : Determine the unit selling price

Unit selling price = Break even (sales revenue) ÷ total units sold

Each of two stocks, A and B, are expected to pay a dividend of $5 in the upcoming year. The expected growth rate of dividends is 10% for both stocks. You require a rate of return of 11% on stock A and a return of 20% on stock B. The intrinsic value of stock A

A. will be greater than the intrinsic value of stock B.

B. will be the same as the intrinsic value of stock B.

C. will be less than the intrinsic value of stock B.

D. cannot be calculated without knowing the market rate of return.

Answers

Answer:

a

Explanation:

Intrinsic value can be determined using the constant dividend growth model

according to the constant dividend growth model

price = d1 / (r - g)

d1 = next dividend to be paid

r = cost of equity

g = growth rate

Stock A = $5/ (0.11 - 0.1) = $500

Stock B = $5/ (0.2 - 0.1) = 50

Intrinsic value of A is greater than that of B

Which of the following statements represents a correct and sequentially accurate economic explanation? a. If net exports rise, total expenditures on goods and services rises, and the AD curve shifts rightward. b. If investment increases, total expenditures on goods and services falls, and the AD curve shifts leftward. c. If consumption falls, total expenditures on goods and services falls, and the AD curve shifts rightward. d. If consumption falls, total expenditures on goods and services rises, and the AD curve shifts leftward.

Answers

Answer:

The statement that represents a correct and sequentially accurate economic explanation is:

a. If net exports rise, total expenditures on goods and services rises, and the AD curve shifts rightward.

Explanation:

Some of the factors that can cause the AD curve to shift rightward are increased consumer spending, declining marginal propensity to save, and an expansionary monetary and fiscal policy. Increased consumer spending can be brought about by increased net exports, which increase the propensity to spend. Declining marginal propensity to save increases the marginal propensity to spend, and this causes the AD curve to shift rightward. When government, through its monetary and fiscal policies, makes more money available, the AD curve shifts rightward, with an increased demand for goods and services.

The statement that represents a correct and sequentially accurate economic explanation is:

a. If net exports rise, total expenditures on goods and services rises, and the AD curve shifts rightward.

The following information should be considered:

Some of the factors that can cause the AD curve to shift rightward are increased consumer spending, declining marginal propensity to save, and an expansionary monetary and fiscal policy. Increased consumer spending can be brought about by increased net exports, which increase the propensity to spend. Declining marginal propensity to save increases the marginal propensity to spend, and this causes the AD curve to shift rightward. When government, through its monetary and fiscal policies, makes more money available, the AD curve shifts rightward, with an increased demand for goods and services.Learn more: brainly.com/question/16911495

Video Planet (VP) sells a big screen TV package consisting of a 60-inch HDTV, a universal remote, and on-site installation by VP staff. The installation includes programming the remote to have the TV interface with other parts of the customer's home entertainment system. VP concludes that the TV, remote, and installation service are separate performance obligations. VP sells the 60-inch TV separately for $1,700, sells the remote separately for $100, and offers the installation service separately for $200. The entire package sells for $1,900.

Required: How much revenue would be allocated to the TV, the remote, and the installation service?

Answers

Answer:

Video Planet (VP)

The revenue that would be allocated to the TV, the remote, and the installation service:

TV = $1,615

Remote = $95

Installation service = $190

Explanation:

a) Data and Calculations:

Sales price of 60-inch TV = $1,700

Sales price of remote = $100

Installation service = $200

Total sales price, if sold separately = $2,000

Sales price of entire package = $1,900

Revenue allocated to the 3 performance obligations:

TV = $1,700/$2,000 * $1,900 = $1,615

Remote = $100/$2,000 * $1,900 = $95

Installation service = $200/$2,000 * $1,900 = $190

Total revenue allocated = $1,900

Which of the following statements about goods and services is TRUE?

a.

The demand for services is independent of time.

b.

A service encounter can consist of one or more moments of truth.

c.

A good example of a nondurable good is furniture.

d.

A durable good is a product that typically lasts for less than three years.

Answers

Answer:

B

Explanation:

A nondurable good is a product that typically lasts for less than three years. An example is food.

A durable good is a product that typically lasts for more than three years. An example is furniture, laptop.

The demand for services is dependent on time. After a period, the service may no longer be needed. For example, consider the demand for the services of a firefighter when a building is on fire. the demand for the firefighters is only needed for the duration that the building is on fire. After the fire has been put out, there would be no need for firefighters

Merchant Company purchased property for a building site. The costs associated with the property were: Purchase Price $ 185,000 Real estate commission $ 15,000 Legal fees $ 700 Expenses of clearing the land $ 2,000 Expenses to remove the old building $ 4,000 What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building

Answers

Answer:

$206,700 to land and $0 to building

Explanation:

In business terms half construction means no construction and therefore, building cost is zero.

The building is under construction means it meant that building have not been completely constructed.

Particulars Amount($)

Purchase price $185,000

real estate commission $15,000

legal fees 700

expense of clearing the land $2000

expense of remove old building $4000

portion of costs that will be allocated to land $206,700

Qu. 13-54 (Algo) Otool Incorporated is considering using stocks of an old raw material... Otool Incorporated is considering using stocks of an old raw material in a special project. The special project would require all 160 kilograms of the raw material that are in stock and that originally cost the company $1,536 in total. If the company were to buy new supplies of this raw material on the open market, it would cost $7 per kilogram. However, the company has no other use for this raw material and would sell it at the discounted price of $6.75 per kilogram if it were not used in the special project. The sale of the raw material would involve delivery to the purchaser at a total cost of $79 for all 160 kilograms. What is the relevant cost of the 160 kilograms of the raw material when deciding whether to proceed with the special project

Answers

Answer:

Otool Incorporated

The relevant cost of the 160 kilograms of the raw material when deciding whether to proceed with the special project is:

= $1,001.

Explanation:

a) Data and Calculations:

Cost of 160 kilograms of the raw material = $1,536

Cost of new supplies of the raw material = $7 per kilogram

= $1,120 ($7 * 160)

Price at which the raw material could be sold = $6.75

Total = $1,080 ($6.75 * 160)

Delivery cost cost from sale of the raw material = $79

Net revenue to be recovered from the sale = $1,001.

The relevant cost is the lower of the replacement cost or the net realizable value. That the lower of $1,120 or $1,001.

Blue Cab Company had 60,000 shares of common stock outstanding on January 1, 2021. On April 1, 2021, the company issued 30,000 shares of common stock. The company had outstanding fully vested incentive stock options for 10,000 shares exercisable at $11 that had not been exercised by its executives. The end-of-year market price of common stock was $23 while the average price for the year was $22. The company reported net income in the amount of $319,915 for 2021. What is the diluted earnings per share (rounded)

Answers

Answer:

$3.46

Explanation:

Diluted earnings per share = Earnings attributable to holders of common stock ÷ Weighted Average Number of Common Stocks outstanding

where,

Earnings attributable to holders of common stock = $319,915

and

Weighted Average Number of Common Stocks outstanding

outstanding on January 1, 2021 = 60,000 shares

additional shares (9/ 12 x 30,000) = 22,500 shares

Option stocks = 10,000 shares

Total = 92,500 shares

therefore,

Diluted earnings per share = $319,915 / 92,500 shares = $3.46

Prepare a Trial Balance The following balances were taken from the general ledger of Howser Corporation as of December 31. All balances are normal

Cash 6000 Accounts receivable 10,800

Accounts payable 6000 Common stock 36000

Equipment 30000 Dividends 2400

Utilities expense 2,000 Administrative expense 8,000

Sales revenue 17,200

Prepare a trial balance Howser Corporation Trial Balanc Dec cember 31.

Answers

Answer:

Trial balance

Particulars Debit Credit

Cash $6,000

Account receivable $10,800

Equipment $30,000

Account payable $6,000

Common Stock $36,000

Dividend $2,400

Sales revenue $17,200

Administrative expense $8,000

Utilities expense $2,000

Total $59,200 $59,200

explain errors are not detected by a trial balance

Answers

Answer:

Errors not detected by a trial balance are:

1. Posting to Wrong Account

2. Error of Amounts in Original Book

3. Compensating Errors

4. Errors of Principle

5. Errors of Omission

Explanation:

The Trial Balance does not provide absolute assurance of ledger account accuracy. It is just an evidence of the postings' arithmetical accuracy. Even though the amount of debits equals the amount of credits, there may be inaccuracies.

A trial balance will not reveal such errors, and they are:

1. Posting to Wrong Account: IF accidentally posted something to the wrong account, but it was on the right side, the Trial Balance agreement will not be affected. For example, if a $200 purchase from John was credited to Joshua instead of John. As a result, Trial Balance will miss such an error.

2. Error of Amounts in Original Book: The Trial Balance will come out appropriately if an invoice for $632 is filed in Sales Book as $623, because the debit and credit have been recorded as $623. The arithmetical precision is there, yet there is a flaw.

3. Compensating Errors: This occurs one mistake is offset by a similar mistake on the other side. These errors are cancelled if one account in the ledger is debited $500 less and another account in the ledger is credited $500 less.

4. Errors of Principle: An errors of Principle is one that breaches the foundations of bookkeeping. Purchases of furniture, for example, are debited to the Purchase Account rather than the Furniture Account; wages paid for the erection of plant are debited to the Wages Account rather than the Plant Account; and the amount spent on a building extension is debited to the Repairs Account rather than the Building Account, and so on. These kind of errors do not alter the total debits and credits, but they do impair the bookkeeping principle.

5. Errors of Omission: There will be no effect on the Trial Balance if a transaction is completely omitted. An error of omission occurs when a transaction is fully unreported in both aspects, or when a transaction is documented in the books of primary entry but never entered in the ledger. For example, if a credit purchase is not recorded in the Purchase Day Book, it will not be posted to both the Purchase Account and the Supplier's Account. This error, on the other hand, will not cause Trial Balance to disagree.

Assume the following information: Current spot rate of New Zealand dollar = $.41 Forecasted spot rate of New Zealand dollar 1 year from now = $.45 One-year forward rate of the New Zealand dollar = $.42 Annual interest rate on New Zealand dollars = 8% Annual interest rate on U.S. dollars = 9% Given the information in this question, the return from uncovered interest arbitrage by U.S. investors with $400,000 to invest is _______ A) about 11.97 B) about 10.63 C) about 11.12 D) about 13.27 E) about 18.54

Answers

Answer:

B) about 10.63

Explanation:

Calculation to determine what return from uncovered interest arbitrage by U.S. investors with $400,000 to invest is

First step is to calculate the Current Amount of New Zealand dollar

New Zealand dollar=$400,000/$.41

New Zealand dollar=$975,609.76

Second step is to calculate the Increase based on the Annual interest rate on New Zealand dollars

Increase in New Zealand dollars = $975,609.76×(1+.08)

Increase in New Zealand dollars = $975,609.76× (1.08)

Increase in New Zealand dollars=$1,053,658.54

Third step is to calculate the forward rate amount of the New Zealand dollar

Forward rate amount of New Zealand dollar = $1,053,658.54× .42

Forward rate amount of New Zealand dollar= $442,536.63

Now let calculate return from uncovered interest arbitrage

Return = ($442,536.63 –$400,000)/$400,000

Return = $42,536.63/$400,000

Return=0.1063*100

Return= 10.63%

Therefore return from uncovered interest arbitrage by U.S. investors with $400,000 to invest is about 10.63 %

Stockton Company Adjusted Trial Balance December 31 Cash 6,175 Accounts Receivable 2,278 Prepaid Expenses 694 Equipment 14,639 Accumulated Depreciation 2,479 Accounts Payable 1,546 Notes Payable 4,744 Common Stock 1,000 Retained Earnings 12,765 Dividends 969 Fees Earned 6,312 Wages Expense 2,622 Rent Expense 708 Utilities Expense 449 Depreciation Expense 262 Miscellaneous Expense 50 Totals 28,846 28,846 Determine the total assets.

Answers

Answer:

$26,265

Explanation:

Assets are economic resources controlled by the entity from which future economic benefits are expected to flow into the entity.

Total Assets Calculation

Cash $6,175

Accounts Receivable $2,278

Prepaid Expenses $694

Equipment $14,639

Accumulated Depreciation ($2,479)

Total $26,265

explain other three marketing activies that must be carried by ds

Answers

양정원

심제이크

박제이

박성훈

김선우

니시무라 리-키

엔하이픈

Ralph has decided to put $2,400 a year (at the end of each year) into an IRA over his 40 year working life and then retire. What will Ralph have at retirement if the account earns 10 percent compounded annually

Answers

Answer:

$1,062,222.13

Explanation:

Calculation to determine What will Ralph have at retirement if the account earns 10 percent compounded annually

Annuity =$2,400

n = 40 years

r = 10%

FVOA=2400*(1+0.1)^40-1/0.1

FVOA=2400∗442.5925557

FVOA=$1,062,222.13

Ralph will have $1,062,223 at retirement